We are excited to let you know about two new software purchases for Foxstone Financial and RPR. These tools are very robust retirement income and tax reduction planning programs. We have been doing a lot of research to find the right options for our practices and what can bring the best solutions for our clients and their needs. The income planning software updates your account values nightly with a direct feed from Schwab. This software is much more complex and presents a more comprehensive viewpoint than what we have been using. It is our opinion that tax reduction planning is an integral part of any successful wealth management plan. The new tax software will enable us to view your tax situation through a discerning process to best determine how to help you pay as little tax as legally possible.

Based on the complexities of both options, there will be additional data needed from you to complete these reports. Below is a small example of the items needed for the income report.

- List of debts, payments, total debt and when the debt will be paid off.

- Home value and current mortgage balance and date it will be paid off.

- Annual payment on home taxes and insurance.

- Value of any other assets such as land, or other property, or collectibles

- Value of 401k’s and amount they are contributing each month and what the employer is contributing.

- Value of any other investments we are not managing.

- Date of death…is there longevity in either family?

- Any special expenses you want included for a period of time, such as vacations over and above your normal monthly expenses. If so, how much and for how many years?

- Any income sources from other sources other than social security?

- Annual incomes

- income need in retirement for basic living expenses. Food, clothing, shelter, utilities, insurances, gas, etc.?

- How much income during retirement for discretionary expenses? Hobbies, travel, entertainment, eating out, etc.?

- How much are you contributing to savings or investments each month?

- Do you want to leave any financial legacy?

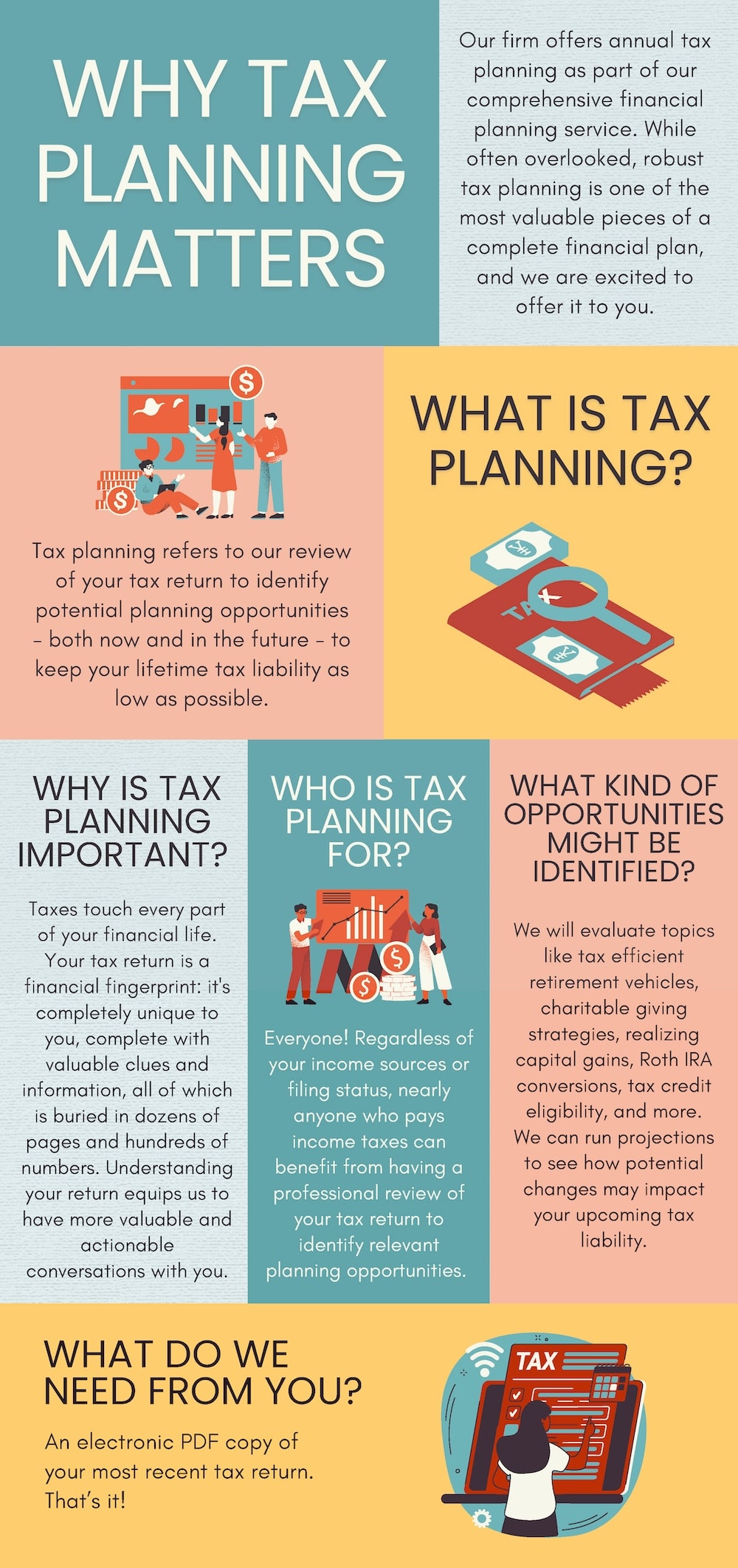

The items needed to analyze the options available to you for tax reduction planning are your most recent filed tax return.

Going forward there will be three options for you to choose from in terms of planning tools available.

- Good – this option is using the retirement planning software we have been using over the past 10 years. There won’t be any additional charges for using this planning tool.

- Better – this option encompasses the new income and retirement planning software that is much more robust and detailed than the good option. The cost for running this detailed report is $500.

- Best – this option entails both the new income and retirement planning software in addition to the new tax reduction software. This report is excellent at combing through your taxes and finding efficient ways to reduce taxes. When we combine this software with our knowledge of tax reduction planning, it is a solid 1-2 punch at reducing taxes on an annual basis. There is also a $500 charge for this report and analysis.

We look forward to showing you how these two new planning tools can have a beneficial impact on your taxes and wealth management plan.