I can’t believe it is already February. I am sitting here watching the rain and snow fall and looking forward to getting out snowboarding in the powder. I hope it continues to snow because we need the moisture.

I am writing this note on February 7th at the close of the market and the S&P500 sits near an all-time high, close to 5,000. It is wild the market has gone up as much as it has lately with the daily news of corporate layoffs, geopolitical tensions and the Federal Reserve not showing any signs of reducing interest rates in the near term. In fact, the S&P500 has only had one down week since December 1st which is unusual to not have a pullback by now. Your investments are experiencing a great start to the year which I am grateful for.

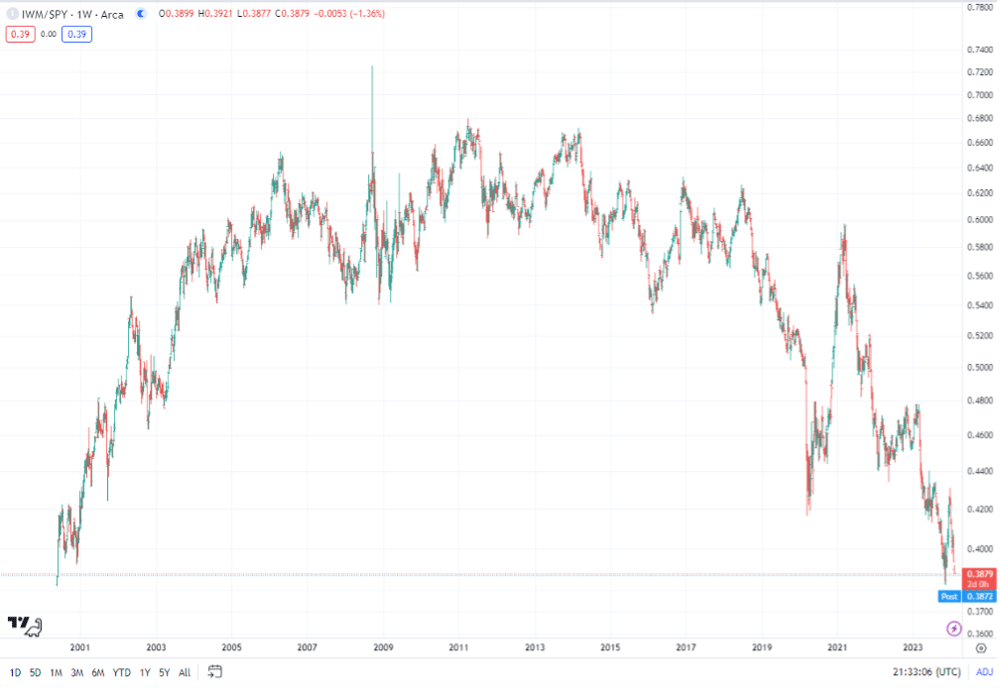

The U.S. equity markets have been driven by a narrow set of stocks for more than a year now, but market leadership today is getting downright razor thin. The only two sectors beating the S&P 500 year-to-date are tech and communication services, although healthcare to be fair is virtually tied. Five S&P 500 sectors are down so far for 2024, three of them by more than 3%. Small caps are down. Developed and emerging markets are down. Treasuries are down. Gold is down. This is not a healthy market environment. The graph below compares the small cap benchmark ETF vs the S&P500 etf. When the graph is going up it means small caps are outperforming large caps, and vice versa. The reason to show this to you, in a bull market, small caps have historically performed better than large caps, but what we are seeing now is the opposite of that. Other than the brief spike in 2009, the small cap ETF hit its high in 2011 and has been losing value to large caps ever since. The financial markets aren’t sustainable when only two or three sectors are participating in the ‘growth of the economy’. The current markets are a perfect example of a rising tide not lifting all boats.

There’s no question that investors got way out over their skis in pricing in 7 rate cuts by the Fed in 2024 and some of that has needed to get priced back out in the short-term, but the long-term fundamentals are getting worse. If you’re paying attention only to GDP growth and non-farm payrolls, you’re missing a lot of the big picture.

The labor market, despite two straight years of a sub-4% unemployment rate, might be at its most vulnerable point for a reversal in a long time. Corporate layoffs, especially in the tech sector, are being announced on almost a daily basis now. Microsoft, Google, Citigroup, Deutsche Bank, eBay, Macy’s, American Airlines, and others have already announced job cuts. Snap and DocuSign were added to the list this week and, while the absolute number of job cuts from these two companies won’t make a big dent in the labor market, it’s a troubling trend that’s getting wider and growing worse. We saw the Challenger job cuts report come in much higher than expected. Continuing jobless claims have moved higher as well. All of this, in my opinion, is evidence that the labor market is weakening, not strengthening, and could be the domino that tips the entire economy.

Then there’s the report from the New York Fed that said credit card delinquencies surged 50% in 2023. All the high-level data, including retail sales figures, suggest that the economy and the consumer are still in a healthy place. In reality, the data illustrates the consumer is getting completely tapped out and all that retail sales growth is being done with credit, not cash. With the U.S. economy in another K-shaped growth cycle, a lot of consumers simply aren’t going to be able to spend in the way that they have over the past couple years. The weakness in consumer behavior & the labor market are intertwined and it’s telling us that the danger levels are getting high.

The algorithms Foxstone uses adjusts based on data and does not forecast what may or may not happen but responds according to data and market events. If you are concerned about the market and want to discuss other options, whether in the private alternative investment market, insurance-based investments, or treasuries, please reach out to me. I am happy to discuss the merits of those investments for you and determine if they are appropriate given your goals.